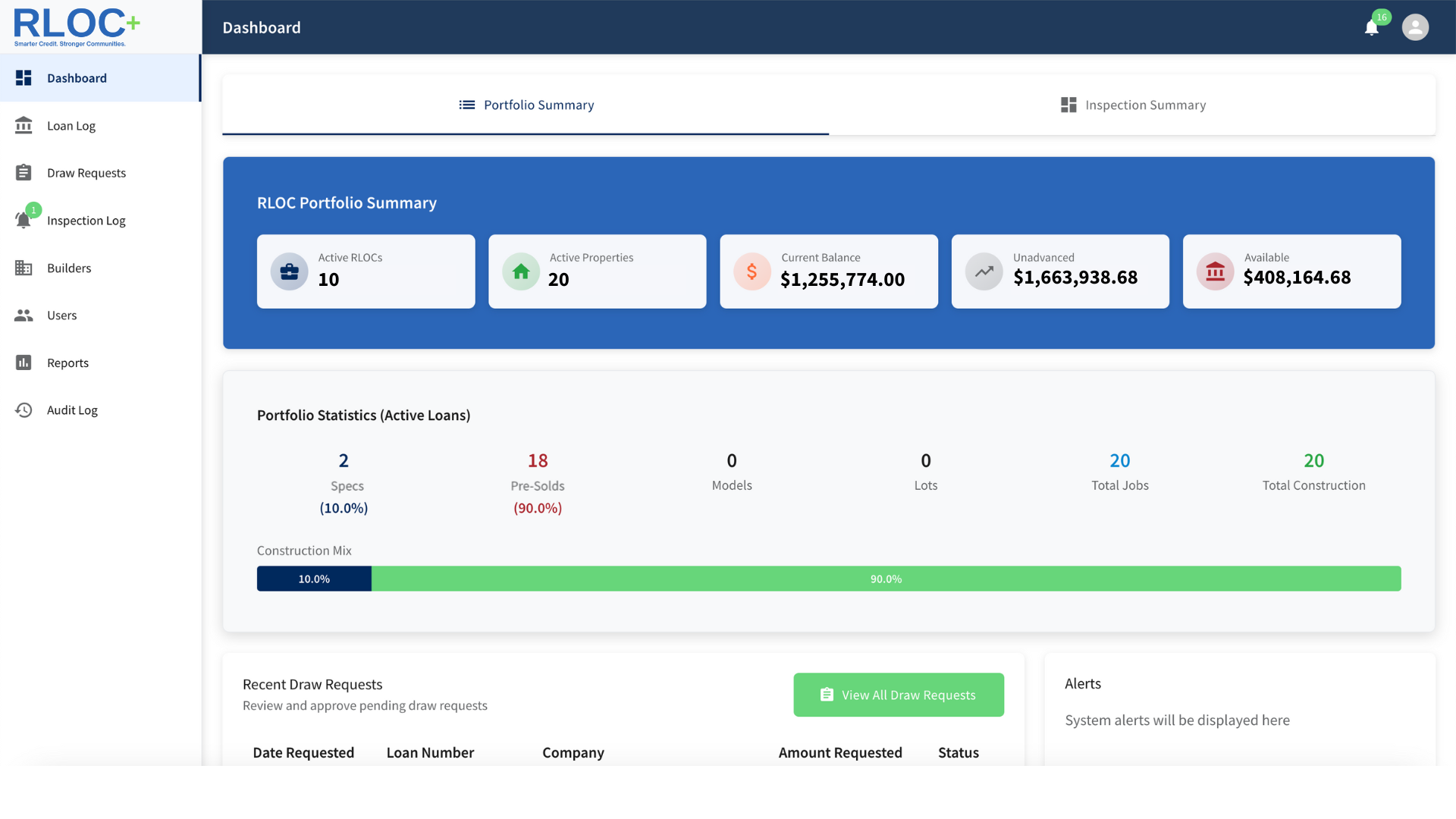

Portfolio Management Software for New Construction Lines

Welcome to RLOC+, compliant loan software that allows banks to issue, monitor, and manage lines of credit for large new home builders.

Enterprise-grade, Tech-stack Agnostic

Features

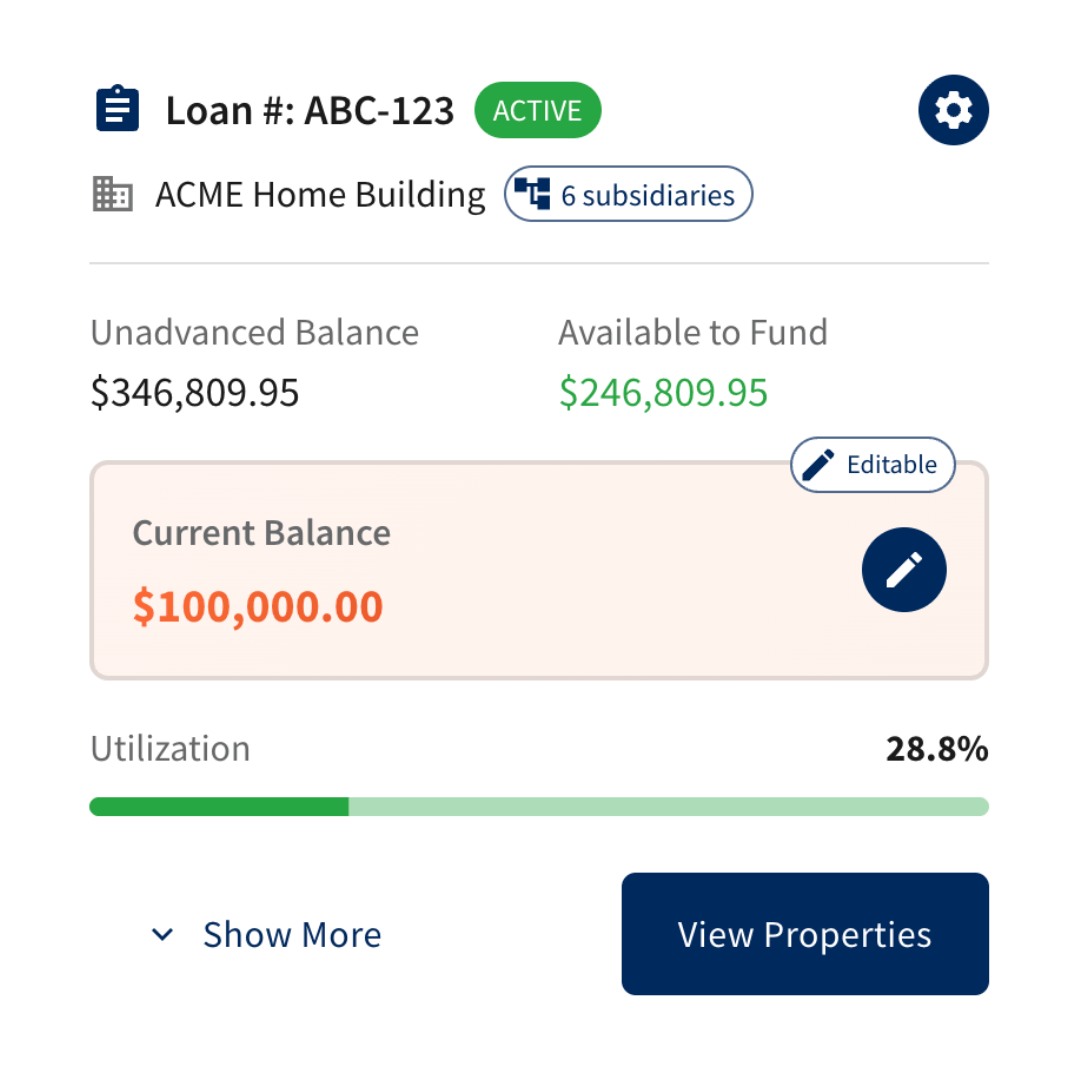

Automated Borrowing Base

Real-time calculations and fund tracking built specifically for aggregate construction lines.

Real-time fund calculation

Automatic borrowing base updates as properties advance through construction stages.

Configurable LTC percentages

Set loan-to-cost ratios by stage to match your bank's lending policies.

Aggregate exposure tracking

Monitor total portfolio exposure across all properties in the master line.

Multi-User Portal Access

Dedicated portals for all stakeholders in the construction lending process.

Builders: Submit draws, track stages

Intuitive builder portal for submitting draw requests and tracking property progress.

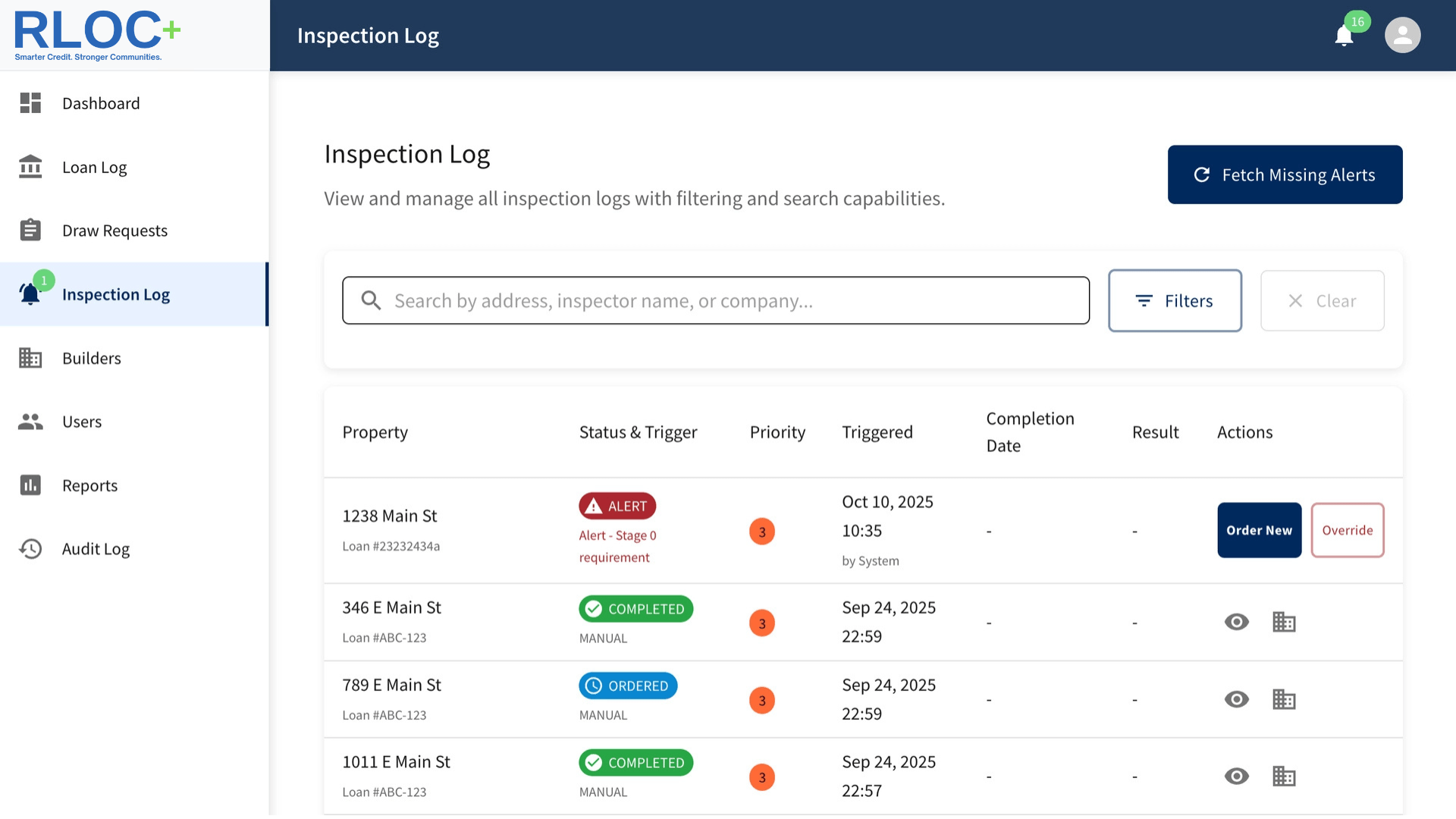

Loan Officers: Process approvals

Streamlined workflow for reviewing draws and ordering inspections.

Inspectors: Upload reports

Direct portal access for inspectors to upload reports and verify stage completion.

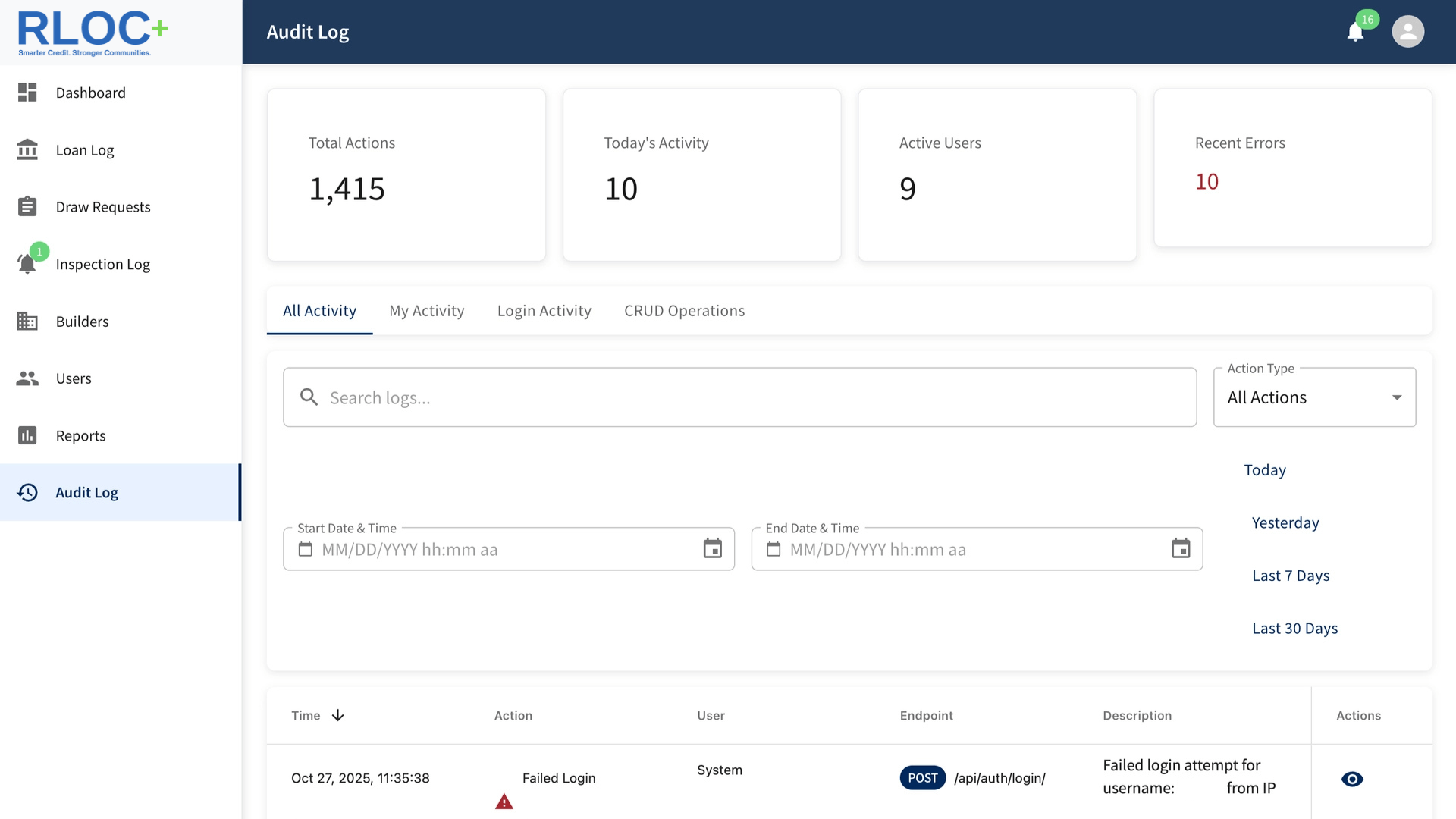

Complete Audit Trail

Examination-ready documentation and compliance controls built into every transaction.

Every action logged

Comprehensive audit trail captures all activities with timestamps and user information.

Role-based permissions

Proper segregation of duties with configurable access controls.

Immutable records

Links draws to inspections and approvals with permanent, exam-ready documentation.

Pricing

Simple, transparent pricing. No surprises.

RLOC+ Core

Best for small lenders and community banks digitizing their construction loan management for the first time.

FEATURES

- Portfolio Dashboard

- Builder / Borrower Portal

- File & Document Management

- Draw Request Tracking

- Analytics Dashboard

- Multi-Branch / Entity Management

- Email support

- Training & Onboarding (1 session included)

- Data Migration & Setup

RLOC+ Growth

Ideal for regional lenders or institutions managing multiple builder relationships.

FEATURES

- Portfolio Dashboard

- Builder / Borrower Portal

- File & Document Management

- Draw Request Tracking

- Analytics Dashboard

- Multi-Branch / Entity Management

- Priority email & phone support

- Training & Onboarding (2 sessions + refresh option)

- Data Migration & Setup

RLOC+ Enterprise

Built for large-scale lenders managing 150+ files.

FEATURES

- Portfolio Dashboard

- Builder / Borrower Portal

- File & Document Management

- Draw Request Tracking

- Analytics Dashboard (Advanced)

- Multi-Branch / Entity Management

- Dedicated support (phone + training on demand)

- Training & Onboarding (Unlimited onboarding + admin training)

- Data Migration & Setup (with customization)

What Our Clients Say

Hear from those who have partnered with us.

Brian Jones

Senior Vice President | Real Estate Loan Officer

PlainsCapital Bank

"RLOC+'s AI-driven insights have transformed how we approach financial planning for our clients. It's an invaluable resource in the modern financial landscape."

Kyle Morse

CEO at Strata52

" RLOC+ was built with security in mind. The ability to self-host an RLOC dasbhoard with audit-ready features are a game changer for banks that loan to large new home builders."

Emily Johnson

Product Manager

"RLOC+ is revolutionizing the management of revolving lines of credit for large new home builders. Its intuitive design and powerful features make it an indispensable tool for anyone serious about managing their loan portfolio."

15-30 Days

From conversation to production deployment for your construction lending platform.

Production-Ready

Built specifically for master construction lines with complete audit trail and compliance controls.

Self-Hosted

Deploy in your own environment with complete data control and no vendor lock-in.

From Conversation to Production in 30 Days

Turn construction lending into a competitive advantage. Schedule your demo today and see how RLOC+ delivers regulatory examination readiness, operational efficiency, and real-time risk monitoring.